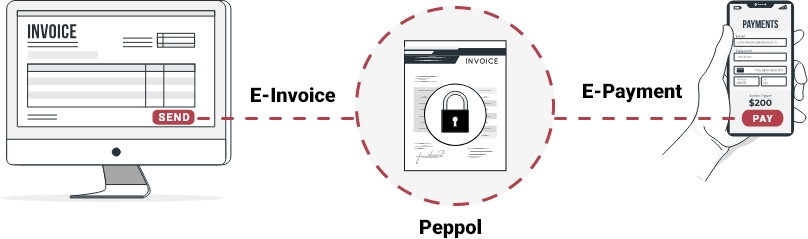

InvoiceNow allows direct transmission of invoices in structured digital format from one finance system to another using the Nationwide E-delivery network, which is based on Peppol, allowing or the invoice to be flipped to E-payments such as Paynow directly.

A single solution cater for different parties including businesses and government, and tax compliance.

Faster invoice issuance from supplier; and reducing manual data entry and errors when keying the invoice into accounting solution.

Invoices are delivered over the secure InvoiceNow network based on the international Peppol standard.

With all records available in the system. It enables a faster checking process and quicker refunds if any.

AutoCount with InvoiceNow feature will be connected to IRAS through Access Points (AP), enabling the transmission of invoice data to IRAS.

Whenever businesses transmit invoice data to IRAS through InvoiceNow, IRAS receives a copy of the invoice data, for both invoices issued or received, and recorded in InvoiceNow solutions like AutoCount.

Supplier (Corner 1/C1) → Access Point (Corner 2/C2) → Buyer’s Access Point (Corner 3/C3) → Buyer (Corner 4/C4)

And the Invoice Data shared to IRAS’s System (Corner 5/C5) through C2 & C3

|

|

V2.0 and below |

V2.2 and later |

Standard InvoiceNow solution |

Standard InvoiceNow

+GST InvoiceNow Solution |

| Accounting Basic | FOC solution package | |

|---|---|---|

| Plug in | ||

| SST, GST, Project, Multi-Currency | ||

| GL, AR, AP, Recurrence GL | ||

| E-Invoicing (PEPPOL) | FREE | |

| Seamless Filling - IRAS - Form C-S - ACRA - Simply XBRL / FS - ACRA - Annual return |

||

| Budget & Advanced Financial Report | ||

| Formula, UDF | ||

| Simple Sales | ||

| Simple Purchase | ||

| Complete Sales | ||

| Complete Purchase | ||

| Complete Stock | FREE | |

| Basic Multi-UOM | ||

| Sales Invoice | FREE | |

| Purchase Invoice | FREE | |

| GST InvoiceNow | FREE | FREE |

| InvoiceNow transaction including B2B and B2G | FREE |

InvoiceNow automates e-invoice transmission, eliminating manual tasks like sending, receipting, and recording.

Automating invoicing reduces errors, rectification costs, and storage expenses by keeping records electronically.

Faster invoice process with InvoiceNow, enhances cashflow management, letting businesses focus on growth.

InvoiceNow helps GST-registered businesses maintain clearer records and minimize incorrect GST claims.

InvoiceNow reduces issues and risks on auditing and speeds up GST refunds claims for business identified as lower-risk level.

Time Saving

With a typical 60-day term invoice through the classic journey excluding financing or factoring, with AutoCount Invoice now solution, the time saved has been estimated to save up as:

Full feature and customizable accounting solution for businesses

SMEs are eligible for up to 50% Productivity Solutions Grant (PSG) support for the adoption of AutoCount Accounting, a Pre-Approved Solution under the IMDA SMEs Go Digital programme.

Find out more

New way of accessing your accounting software where and when you need it

Find out moreRegister Steps

Contact AutoCount for assistance or follow the steps below:

Visit PEPPOL or email IMDA to register,

Email Registration to AutoCount

Received the PEPPOL ID within a few days.

Register PEPPOL ID into AutoCount E-Invoicing, and start send and received the E-invoice

Or contact AutoCount to for assistance in getting InvoiceNow ready

FAQs

General Questions

InvoiceNow to Government

Cost & Benefits to Organisations

How Do I Get Connected?

Network Security